BTC Price Prediction: Why Analysts Remain Bullish Despite Short-Term Volatility

#BTC

BTC Price Prediction

BTC Technical Analysis: November 2025 Outlook

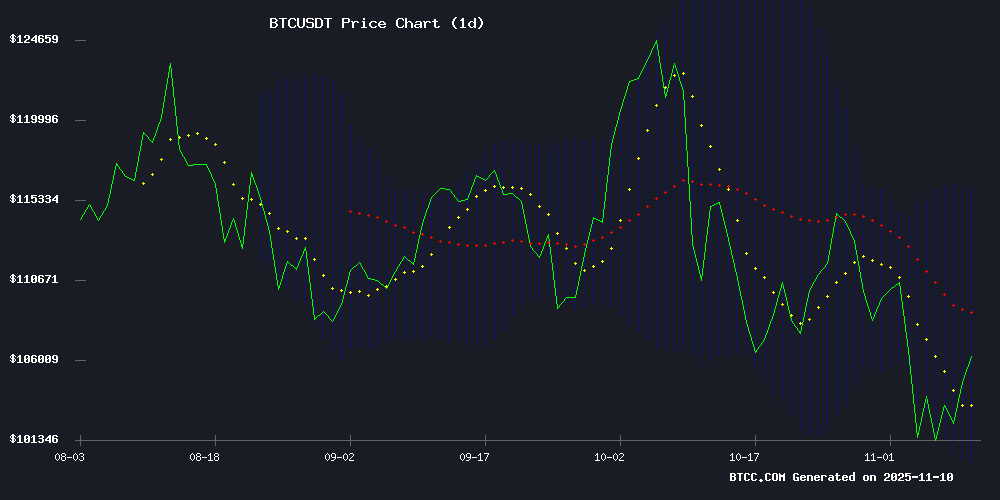

According to BTCC financial analyst Ava, Bitcoin (BTC) is currently trading at, slightly below its 20-day moving average (MA) of. The MACD indicator shows bullish momentum with a positive histogram value of, suggesting potential upward movement. Bollinger Bands indicate moderate volatility, with the price hovering near the middle band. While short-term resistance lies at, a breakout could signal further gains.

Market Sentiment: Bullish Catalysts for Bitcoin

BTCC analyst Ava highlights strong bullish sentiment driven by macroeconomic and institutional developments. Key catalysts include:

- U.S. regulatory progress (Treasury's crypto bill hints)

- Corporate adoption (MicroStrategy's $49.9M BTC purchase)

- Infrastructure growth (Square enabling BTC payments for 4M merchants)

- Macro liquidity shifts (stablecoin supply contraction)

These factors align with technical indicators suggesting accumulation phase.

Factors Influencing BTC’s Price

Bitcoin Recovers as Analysts Project Bullish Year-End Targets

Bitcoin is showing signs of recovery following a recent selloff, with Wall Street analysts issuing bullish year-end price forecasts ranging from $120,000 to $200,000. The rebound suggests the worst of October's derivatives-linked downturn may be over, though catalysts for sustained upward momentum remain unclear.

Crypto-related equities like Coinbase Global and Robinhood rallied Monday, while MicroStrategy held steady. Market observers are divided on potential drivers—some view resolution of the U.S. government shutdown as a positive catalyst, while others see Bitcoin regaining appeal as a hedge against lingering macroeconomic uncertainty.

The cryptocurrency now faces a critical juncture: while October's negative sentiment appears to be fading, the market lacks clear triggers to bring sidelined capital off the sidelines. This creates a tension between technical recovery potential and fundamental demand drivers that will likely determine Bitcoin's trajectory through year-end.

U.S. Treasury Secretary Hints at Crypto Market Revolution in New Bill

U.S. Treasury Secretary Scott Bessent has signaled a seismic shift in American finance through the proposed crypto market Structure Bill. His endorsement suggests blockchain technology could unlock "the awesome full potential of the American capital market," potentially redirecting trillions into digital assets.

The announcement follows President Trump's November 9 declaration supporting the crypto Structure Bill 2025, which aims to replace traditional finance with a cryptocurrency framework. "We want to create more economic freedom and update the financial system," said Coinbase CEO Brian Armstrong, echoing the sentiment for systemic change.

This dual endorsement from top government officials marks a watershed moment for institutional crypto adoption. The legislation could catalyze the largest capital migration in financial history, with bitcoin positioned as the cornerstone asset.

Stablecoin Supply Shrinks as Bitcoin Rebounds Above $105K, Signaling Liquidity Shift

Bitcoin claws back above $105,000 after a violent dip below six figures triggered cascading liquidations. The recovery aligns with fading fears of a U.S. government shutdown, though CryptoQuant data reveals an ominous countertrend: stablecoin reserves are contracting for the first time in months.

Market mechanics suggest trouble when stablecoin liquidity dries up. These dollar-pegged tokens act as dry powder for crypto purchases—their dwindling supply historically foreshadows weakened buying pressure. Traders now face a paradox: bullish price action clashes with shrinking on-ramps for fresh capital.

The divergence creates a fragile equilibrium. Bitcoin’s technical structure shows stabilization, but the liquidity pulse warns of potential volatility ahead. All eyes turn to macro catalysts—whether Washington’s fiscal decisions can offset tightening crypto market conditions.

NY Deal Sends Crypto Miner GREE Soaring Over 30% – Here’s What Happens Next

Shares of Greenidge Generation Holdings surged more than 30% at Monday’s open after the Bitcoin mining and power-generation company secured a major regulatory breakthrough with New York State. The company announced an agreement with the New York State Department of Environmental Conservation to renew its Title V Air Permit for its Dresden facility, ending a years-long legal battle.

The five-year permit allows Greenidge to continue its combined power-generation and cryptocurrency-mining operations while committing to emissions cuts surpassing state climate targets. Under the terms, Greenidge must reduce its permitted greenhouse gas output by 44% and actual emissions by 25% by 2030, exceeding the statewide goal of 40%.

"This new permit includes historic emissions reductions that go far beyond anything required," said company president Dale Irwin, framing the deal as proof of Greenidge’s ability to operate as a responsible cryptocurrency business while supporting grid stability.

U.S. Government Shutdown Relief Lifts BTC Above $105k Amid ETF Outflows

Bitcoin surged past $105,000 as risk appetite improved following progress toward resolving the U.S. federal shutdown. The Senate advanced a funding package on November 10, 2025, easing near-term policy uncertainty and stabilizing market sentiment. Despite the rally, the Crypto Fear & Greed Index remained in 'fear' territory, reflecting lingering caution among investors.

Spot Bitcoin ETFs continued to face headwinds, with net outflows reaching $1.2 billion over the past week. These redemptions have consistently absorbed upward price movements, particularly during New York trading hours. Long-term holders have been net sellers since late October, compounding pressure from ETF outflows and recycling supply into the market during rallies.

Jack Dorsey's Block Inc. Enables Bitcoin Payments for 4 Million Merchants via Square

Block Inc., led by CEO Jack Dorsey, has activated Bitcoin-to-Bitcoin payments for over 4 million merchants using its Square payment system. The feature supports multiple settlement options, including BTC-to-BTC, BTC-to-fiat, and fiat-to-BTC conversions, with zero fees until 2027 followed by a nominal 1% charge—undercutting traditional credit card rates.

Dorsey confirmed the rollout on X, emphasizing global accessibility for all merchants, not just Square users. The initiative, first hinted at on April 3, promises instant settlement and marks a strategic push for broader Bitcoin adoption in commerce.

Silver Outshines BTC in 2025 Rally as Precious Metals Dominate

Silver surged past $50, marking a 58% year-to-date gain and eclipsing Bitcoin's 30% growth. The precious metal now leads as 2025's top-performing asset, fueled by speculative demand and record bullion inflows into London vaults.

Bitcoin's dominance wanes as institutional interest shifts toward tangible assets. Despite trading above $105,000, BTC struggles to match silver's momentum. Analysts speculate whether Q4 will bring a reversal or cement metals' supremacy.

London's silver reserves hit a nine-year high, alleviating shortage concerns after April's supply squeeze drove prices to $54/oz. This sustained physical demand creates headwinds for crypto's liquidity rotation narrative.

Bitdeer Revenue Soars 173% on Self-Mining Surge Amid Bitcoin Weakness

Bitdeer's third-quarter revenue skyrocketed 173%, driven by a dramatic increase in self-mined Bitcoin and favorable market conditions. The company mined 1,109 BTC—more than double its output from the same period last year—while phasing out lower-margin cloud contracts. Self-mining revenue alone surged to $130.9 million from $31.5 million year-over-year.

Despite the operational success, Wall Street reacted negatively as Bitdeer's stock (BTDR) fell over 9%. Analysts attributed the decline to broader Bitcoin price softness overshadowing earnings. The company posted a net loss of $266.7 million, though adjusted EBITDA turned positive at $43 million, signaling improved mining efficiency.

Bitdeer's balance sheet shows $196.3 million in cash and $246.2 million in crypto holdings, but operating expenses ROSE in tandem with revenue growth. The strategic shift toward self-mining has delivered higher yields, yet market sentiment remains tethered to Bitcoin's volatility.

Trump's $2,000 Stimulus Plan Sparks Bitcoin Rally Speculation

US President Donald Trump's announcement of $2,000 stimulus checks has reignited debates among crypto analysts about a potential Bitcoin rally. Historical precedent suggests such cash injections could fuel BTC demand, mirroring the 2020 surge following the CARES Act.

When $1,200 checks hit American bank accounts in April 2020, Coinbase and Binance reported spikes in exact-amount Bitcoin purchases. BTC stood at $6,800 then - a far cry from today's $106,317. The cryptocurrency subsequently rallied 50% within six weeks, launching its historic bull run.

The mechanics remain clear: liquidity injections create disposable income, some portion of which flows into risk assets. With crypto markets more mature today, the potential multiplier effect could be even greater. Market watchers note Bitcoin's correlation with fiscal stimulus has become part of its macro narrative.

MicroStrategy Bolsters Bitcoin Holdings with $49.9M Purchase Amid Market Rebound

MicroStrategy, now rebranded as Strategy, has added 487 BTC to its treasury at an average price of $102,557 per coin, bringing its total holdings to 641,692 BTC. The $49.9 million acquisition underscores the firm's unwavering commitment to Bitcoin accumulation despite recent market volatility.

The company's total investment now stands at $47.54 billion, with an average purchase price of $74,079 per BTC. Year-to-date returns of 26.1% demonstrate the resilience of its strategy. Executive Chairman Michael Saylor's cryptic tweet—"₿est Continue"—signaled the move, reinforcing institutional confidence in Bitcoin's long-term value proposition.

Concurrently, Strategy announced plans to raise $715 million through a stock offering, earmarked for further Bitcoin purchases. The news coincides with BTC's rebound above $106,000, reflecting renewed market optimism.

Strive Asset Management Acquires $162M in Bitcoin Amid Market Volatility

Vivek Ramaswamy's Strive Asset Management has bolstered its Bitcoin holdings with a $162 million purchase of 1,567 BTC, averaging $103,315 per coin. The MOVE elevates Strive's total Bitcoin treasury to 7,525 BTC, reinforcing its stance that Bitcoin is "the most secure, transparent, and resilient reserve asset available to corporations."

The acquisition follows Bitcoin's sharp pullback to $100,000 last week—its worst weekly performance this year—before rebounding to $105,000 at press time. Strive, which manages $2 billion in assets, recently went public in September and has rapidly positioned itself as a crypto-forward investment firm.

"Strive is now the first Bitcoin treasury company to finance its amplification exclusively through perpetual preferred equity," said CEO Matt Cole, drawing parallels to MicroStrategy's aggressive accumulation strategy. The purchase signals growing institutional conviction despite short-term price turbulence.

Is BTC a good investment?

Based on current technicals and market dynamics, BTCC's Ava presents a data-driven investment thesis:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | -1.8% discount | Mean reversion potential |

| MACD Histogram | +1,498.04 | Bullish momentum |

| Bollinger Band Position | Middle range | Neutral volatility |

With institutional inflows and regulatory clarity improving, BTC demonstrates characteristics of a strategic hold despite near-term fluctuations.

- Technical Strength: MACD bullish crossover and MA support suggest accumulation opportunity

- Institutional Demand: $212M in corporate BTC purchases this week alone

- Macro Tailwinds: Potential U.S. stimulus and ETF developments may drive liquidity